Traze Broker Review: Expansive Trading Options for Every Trader

Traze Overview & Company Background

Traze is a comprehensive online trading platform that offers a variety of financial instruments including Forex, stocks, and commodities. It provides a wide range of accounts to cater to different trading needs, with leverage options up to 1:2000 and competitive spreads. Traze supports the popular MetaTrader 4 platform along with its own mobile trading app, emphasizing accessibility and ease of use. Additionally, Traze offers educational resources and copy-trading options to support both new and experienced traders.

Traze Broker is operated by Zeal Capital Market (Seychelles) Limited and was set up in 2017, with its headquarters in Mahe Seychelles. It is a regulated Securities Dealer with license number SD027 from the Financial Services Authority of Seychelles. Its products available in trading include Forex, indices, commodities, cryptocurrencies, and share CFDs.

MT4 is accessible at Traze that supports Windows, Mac and mobile devices. The proprietary application for mobile is available for iOS and Android users. The leverage is very high here; the maximum leverage is up to 1:2000, thus suitable for that segment of traders who prefer serious exposure with relatively low capital.

This broker places an emphasis on transparency and ease of access while setting itself to develop trading that is easily accessible and fair for its clients.

Although Traze has crossed quite a few milestones forward in the trading sector, there have been mixed opinions about the status of this particular company and its regulatory setup. Some regulators have termed it a “Suspicious Clone” under various regulations including UK’s FCA and Seychelles’ FSA. Caution and careful research are recommended to any potential client interested in dealing with this particular broker.

In summary, Traze Broker offers a wide range of trading instruments and platforms, and it therefore represents an interesting proposition for beginners and experienced traders. However, prospective clients should first of all establish the position of the broker on the regulatory side before making any conclusions.

- Regulated Broker: Operates under Zeal Capital Market (Seychelles) Limited and is licensed by the Financial Services Authority (FSA) of Seychelles (License No. SD027).

- Trading Instruments: Offers 30+ forex pairs, commodities, indices, share CFDs, and cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

- Platforms: Provides access to MetaTrader 4 (MT4) for Windows, Mac, and mobile, along with a proprietary mobile app for iOS and Android.

- Account Types: Offers Cent, Standard STP, and ECN accounts with minimum deposits starting at $15 and leverage up to 1:2000.

- Transparency & Accessibility: Emphasizes straightforward and accessible services for both novice and experienced traders.

- Country Restrictions: Does not provide services to residents of the US, Brazil, Canada, Egypt, Iran, North Korea, and EU countries.

Pros & Cons Analysis

- Diverse Trading Instruments: Traze offers a wide range of assets, including over 30 forex currency pairs, commodities, indices, share CFDs, and cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

- High Leverage: The broker provides leverage up to 1:2000, allowing traders to control larger positions with a smaller capital outlay.

- Multiple Account Types: Traze caters to various trader needs with account options such as Cent, Standard STP, and ECN accounts, each with different minimum deposit requirements and features.

- Advanced Trading Platforms: Clients have access to the MetaTrader 4 (MT4) platform, compatible with Windows, Mac, and mobile devices, as well as a proprietary mobile application for iOS and Android.

- Regulatory Concerns: Some sources have raised issues regarding Traze's regulatory status, labeling it as a "Suspicious Clone" under multiple regulations, including the UK's FCA and Seychelles' FSA.

- High Minimum Deposit for Bank Transfers: The broker requires a minimum deposit of $1,000 for bank transfers, which may be a barrier for traders with limited capital.

- Limited Educational Resources: While Traze advertises trading tools and educational materials, some users have reported a lack of accessible resources, which could hinder learning and strategy development.

- Restricted Services in Certain Countries: Traze does not provide services for residents of specific countries, including the United States, Brazil, Canada, Egypt, Iran, North Korea, and European Union countries.

Is Traze Regulated and Safe?

Traze Broker operates under the legal entity Zeal Capital Market (Seychelles) Limited, which is regulated as a Securities Dealer by the Financial Services Authority (FSA) of Seychelles, holding license number SD027.

This regulatory oversight mandates adherence to specific financial standards and operational protocols designed to protect client interests.

In terms of security measures, Traze emphasizes the implementation of top-tier security practices to safeguard client funds and personal information.

While specific details on data protection strategies and fund segregation are not explicitly outlined in the available sources, reputable brokers typically employ advanced encryption technologies and maintain segregated accounts to ensure client funds are kept separate from the company’s operational funds.

However, it’s important to note that some sources have raised concerns regarding Traze’s regulatory status, labeling it as a “Suspicious Clone” under multiple regulations, including the UK’s Financial Conduct Authority (FCA) and Seychelles’ FSA.

This suggests potential issues with the broker’s legitimacy and compliance with regulatory standards.

Given these mixed signals, potential clients are advised to conduct thorough due diligence before engaging with Traze Broker. Verifying the broker’s regulatory status through official channels and assessing the robustness of its security measures are prudent steps to ensure the safety of one’s investments.

- Financial Services Authority (FSA)

- UK's Financial Conduct Authority (FCA)

Trading Conditions & Costs

What Can I Trade with Traze Broker?

Traze Broker offers a diverse array of trading instruments, catering to various investor preferences.

- Forex: Access to over 35 currency pairs, including major, minor, and exotic pairs, with competitive spreads and no commission.

- Shares: Trade share CFDs from globally recognized blue-chip companies, allowing exposure to the stock market without owning the underlying assets.

- Commodities: Engage in trading commodities such as gold, silver, oil, and natural gas, enabling diversification into tangible assets.

- Indices: Trade on major global indices, including NAS100, S&P500, and HK50, providing opportunities to speculate on broader market movements.

- Cryptocurrencies: Participate in the cryptocurrency market with access to Bitcoin, Ethereum, and Litecoin, capitalizing on the volatility of digital assets.

This extensive range of instruments allows traders to build diversified portfolios and explore various market opportunities through Traze Broker’s platform.

- Forex

- Shares

- Commodities

- Indices

- Cryptocurrencies

Traze Trading Platforms & Tools

Opening an account with Traze Broker is a straightforward process designed to get you trading efficiently. Follow these steps to set up your account:

- Registration:

- Visit the Traze Website: Navigate to the official Traze website and click on the “Open an account” button at the top of the page.

- Complete the Registration Form: Provide your full name, phone number, and email address. Create a secure password for your account.

- Email Verification: After submitting the form, you’ll receive a verification email. Click on the verification link to confirm your email address.

- Account Selection:

- Choose an Account Type: Traze offers multiple account types to cater to different trading needs:

- Standard STP Trading Account: Features no commissions with spreads starting from 1.3 pips.

- ECN Trading Account: Offers lower spreads starting from 0.2 pips, with a commission charged per trade.

- Select the Account That Suits You: Based on your trading preferences and capital, choose the account type that aligns with your goals.

- Personal Information:

- Log In to MyTraze: Access your personal dashboard by logging in with your credentials.

- Complete Personal Details: Fill in additional personal information as required, such as date of birth and address.

- Identity Verification:

- Navigate to Document Verification: In your dashboard, go to “Personal Information” and select “Document Verification.”

- Upload Proof of Identity: Provide a clear copy of a valid ID, such as a national ID card, driver’s license, or passport.

- Upload Proof of Residence: Submit a recent utility bill or bank statement (not older than six months) that displays your name and address.

- Bank Account Verification:

- Access Payment Verification: In the dashboard, click on “Personal Information” and then “Payment Verification.”

- Enter Bank Details: Provide your bank account information to facilitate deposits and withdrawals.

- Upload Bank Statement: Submit a copy of a bank statement (not older than six months) to verify your account.

- Application Review:

- Processing Time: Traze’s verification team typically reviews new applications within 24 business hours.

- Notification: You’ll receive an email notification once your account has been verified and approved.

- Funding Your Account:

- Deposit Funds: After approval, deposit funds into your trading account using available methods such as bank transfers, credit/debit cards, or e-wallets.

- Start Trading:

- Download the Trading Platform: Traze offers the MetaTrader 4 (MT4) platform compatible with Windows, Mac, and mobile devices.

- Log In: Use your account credentials to access the trading platform.

- Begin Trading: With funds in your account, you can start trading various instruments offered by Traze.

By following these steps, you can set up and verify your Traze Broker account, enabling you to engage in trading activities efficiently.

- Visit Website: Go to the Traze website and click "Open an account."

- Fill Form: Enter your name, email, phone, and create a password.

- Verify Email: Check your email and confirm the link sent.

- Choose Account: Select an account type (Standard STP or ECN).

- Add Details: Log in and complete personal information in the dashboard.

- Upload Documents: Provide ID and proof of address for verification.

- Verify Bank: Add bank details and upload a recent bank statement.

- Deposit & Trade: Fund your account, log in to MT4, and start trading.

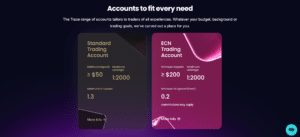

Traze Account Types & Minimum Deposit

Traze Broker offers a variety of account types to cater to different trading needs. Below is a comparison of the available accounts:

| Account Type | Minimum Deposit | Base Currency | Minimum FX Spread | Maximum Leverage | Standard Lot Contract Units | Stop-Out Level | Minimum Trade Size (Standard Lot) | Maximum Single Order (Standard Lots) | Maximum Open Positions (Standard Lots) |

| Cent Trading | $15 | USD | 1.5 pips | 1:2000 | 1,000 | 20% | 0.01 | 100 | 200 |

| STP Trading | $50 | USD | 1.3 pips | 1:2000 | 100,000 | 30% | 0.01 | 30 | 200 |

| ECN Trading | $200 | USD | From 0.2 pips | 1:2000 | 100,000 | 50% | 0.01 | 50 | 200 |

Each account type is designed to accommodate traders with varying experience levels and capital availability. The Cent Trading account is suitable for beginners, offering lower contract sizes and a minimal deposit requirement. The STP Trading account provides standard trading conditions with competitive spreads, while the ECN Trading account caters to advanced traders seeking the lowest spreads and direct market access.

Deposits & Withdrawals

Traze Broker offers a variety of deposit and withdrawal methods to accommodate its global clientele.

Deposit Methods:

- International Bank Transfer: Clients can transfer funds in US dollars to Traze’s DBS bank account in Singapore. The minimum deposit for this method is $1,000, with no maximum limit. Funds typically arrive within two days.

- Local Bank Transfer: Available for clients in Southeast Asia, including Thailand, Malaysia, Indonesia, and Vietnam. This method allows deposits in local currencies, which are converted to US dollars upon receipt.

- Credit/Debit Cards: Traze accepts VISA and Mastercard, with a minimum deposit of $200 and a maximum of $10,000. The payment processor acquires US dollars, and the bank determines the foreign exchange rate.

- E-wallets: Supported e-wallets include Skrill, Neteller, and Perfect Money. Clients can use their e-wallet balance to fund their trading accounts.

Withdrawal Methods:

- Original Payment Method: Withdrawals are processed back to the original payment method used for the deposit. The amount withdrawn to the original method cannot exceed the deposited amount.

- Bank Account: Profits exceeding the deposited amount must be withdrawn to a verified bank account. Clients need to ensure their identity and bank account are properly verified before initiating withdrawals.

Processing Times and Fees:

- Processing Time: The finance team processes withdrawals within 24 hours, provided all information is correct. The actual time for funds to appear in the client’s account depends on the payment method used.

- Fees: Traze does not charge fees for deposits or withdrawals. However, clients should be aware that their bank or third-party payment provider may impose fees, especially if the account is not denominated in US dollars, leading to currency conversion costs.

Clients are advised to verify their identity and bank account to ensure smooth processing of withdrawals. Additionally, it’s important to consider the impact of withdrawals on account margin, as withdrawing funds can affect the margin level and potentially lead to margin calls or stop-outs.

How to trade with Traze? Step-by-Step Guide

Trading with Traze Broker involves a series of steps designed to provide a seamless experience for both novice and experienced traders.

- Account Registration:

- Visit the Traze Website: Navigate to the official Traze website and click on the “Open an account” button at the top of the page.

- Complete the Registration Form: Provide your name, phone number, email address, and create a secure password. Verify your email address to proceed.

- Account Verification:

- Personal Information: Log in to your MyTraze personal zone and navigate to “Personal Information” > “Document Verification.”

- Submit Identification Documents: Upload valid proof of identity (e.g., national ID card, driver’s license, or passport) and proof of residence (e.g., recent utility bill or bank statement not older than six months).

- Bank Account Verification: In the same section, provide your bank account details and upload a copy of your bank statement to facilitate deposits and withdrawals.

- Funding Your Account:

- Deposit Funds: Once your account is verified, deposit funds using available methods such as bank transfers, credit/debit cards, or e-wallets. Note that the minimum deposit varies depending on the chosen account type.

- Platform Access:

- Download Trading Platform: Traze offers the MetaTrader 4 (MT4) platform compatible with Windows, Mac, and mobile devices. Download the appropriate version from the Traze website.

- Log In: Use your account credentials to log in to the MT4 platform.

- Placing Trades:

- Select an Instrument: Choose from a variety of trading instruments, including forex pairs, commodities, indices, shares, and cryptocurrencies

- Analyze the Market: Utilize MT4’s advanced charting tools and technical indicators to conduct market analysis.

- Execute Orders: Decide on the trade size and direction (buy or sell), set stop-loss and take-profit levels, and execute the order.

- Monitoring and Managing Trades:

- Track Performance: Monitor open positions and account balance through the MT4 platform.

- Adjust Orders: Modify or close positions as needed based on market movements and your trading strategy.

By following these steps, traders can effectively navigate the Traze Broker platform and engage in various trading activities.

Customer Support

Traze Broker offers multiple customer support channels to assist clients with their trading needs.

Support Channels:

- Email Support: Clients can reach out to the support team via email at cs@traze.com for assistance with account-related queries, technical issues, or general inquiries.

- Live Chat: For immediate assistance, Traze provides a live chat feature on their website, enabling real-time communication with support representatives.

- 24-Hour Hotline: Traze offers a 24-hour hotline at 400-8692-878, allowing clients to speak directly with support personnel for urgent matters.

Availability and Languages:

- Operating Hours: Customer support is available 24 hours a day, five days a week, aligning with global trading hours to provide timely assistance.

- Languages Supported: While specific languages are not detailed in the available sources, Traze’s global presence suggests support in multiple languages to cater to a diverse clientele.

In summary, Traze Broker provides a range of customer support options, including email, live chat, and a 24-hour hotline, to ensure clients receive prompt and effective assistance. The availability of support during trading hours and the provision of multiple communication channels reflect Traze’s commitment to client service.

Traze Final Verdict

In conclusion, while Traze Broker offers a user-friendly platform with a wide array of trading instruments and account options, potential clients are advised to conduct thorough due diligence, particularly concerning regulatory compliance and risk management features, before engaging with the broker.

- Diverse Trading Instruments: Traze Broker offers a wide range of assets, including forex, commodities, indices, shares, and cryptocurrencies, catering to various trading preferences.

- Advanced Trading Platform: The integration of MetaTrader 4 (MT4) provides traders with advanced charting tools and analytical features, enhancing the trading experience.

- Multiple Account Options: Traze offers various account types—Cent, Standard STP, and ECN—to accommodate different trading needs and capital levels.

- High Leverage: The broker provides leverage up to 1:2000, allowing traders to control larger positions with a smaller capital outlay.

- Regulatory Concerns: Some sources have labeled Traze as a "Suspicious Clone" under multiple regulations, including the UK's Financial Conduct Authority (FCA) and Seychelles' Financial Services Authority (FSA).

- Risk Management: The absence of explicit negative balance protection requires traders to implement robust risk management strategies to safeguard their investments.

Frequently Asked Questions

About Author

Beatrice Quinn

Beatrice Quinn Kingsley, a finance graduate from the London School of Economics, dove into finance clubs during her studies, honing her skills in portfolio management and risk analysis. With a career spanning prestigious firms like Barclays and HSBC, she's become an authority in asset allocation and investment strategy, known for her insightful reports. Beyond her corporate success, Beatrice is an advocate for financial literacy, actively engaging in workshops, seminars, and writing on topics like personal finance and investing. Recognized in the field, she's a featured voice in publications and a sought-after consultant, combining her financial know-how and communication prowess to empower ...User Reviews

Be the first to review “Traze Broker Review: Expansive Trading Options for Every Trader” Cancel reply

- Traze Overview & Company Background

- Pros & Cons Analysis

- Is Traze Regulated and Safe?

- Trading Conditions & Costs

- What Can I Trade with Traze Broker?

- Traze Trading Platforms & Tools

- Traze Account Types & Minimum Deposit

- Deposits & Withdrawals

- How to trade with Traze? Step-by-Step Guide

- Customer Support

- Traze Final Verdict

- Frequently Asked Questions

- About Author

There are no reviews yet.